Upon arrival or departure from the Netherlands, you are required to file a migration income tax return, or M-biljet. With this form, you file a tax return for the period you were a tax resident in the Netherlands, and any tax liability for the period you stayed abroad and were considered foreign taxpayers.

Traditionally, the M form was provided only as a 90-page paper form in Dutch. In international situations, the language barrier and the size of the form has always been a challenge. Especially for those who do not know the Dutch language well and/or have no knowledge of the Dutch tax system. The good news is that from 1 June 2021, the Dutch tax authorities have made the M-bill available digitally. The form is from now on available in the Dutch tax authorities’ digital portal. This is good news, but we still make some comments and remarks.

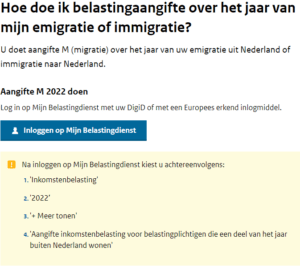

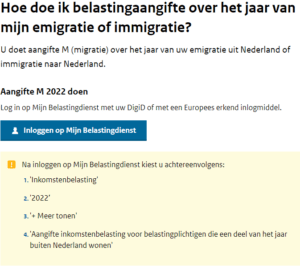

In the Dutch tax administration’s online portal where taxpayers can consult and submit their returns, the tax return form for domestic taxpayers (P-biljet) is the standard form. If a different situation applies, it is important to look carefully at the various other forms, such as the M-biljet for the income tax return in a migration situation. The correct tax form/tax return form that applies is not automatically generated. So pay close attention to this.

Following the above, the question arises as to which form should be used in your situation. Answering this question requires sufficient understanding of the Dutch tax system and the specifics of the various tax returns. This is even more so in the case of an M-form as this is a combined tax return for residents and non-residents of the Netherlands. Completing the M-form is quite complex.

An M-biljet is for both emigration and immigration situations. So for Dutch residents leaving the Netherlands, the Dutch language of the M-biljet will not be an obstacle. For most foreigners coming to the Netherlands, it will be almost impossible to understand the Dutch language in the M-biljet.

Unfortunately, the M form made available online by the tax authorities is still only available in Dutch. This can cause problems for non-Dutch speakers. Hopefully, the tax authorities will soon come up with an English version of the M form.

In short, filing the M-tax return can be challenging. There are a host of issues in the income tax return that require special attention. Guidance from a tax advisor familiar with international income tax situations is therefore strongly recommended. Should you need help in preparing and filing your Dutch income tax return, contact our Global Mobility services specialists. We will be happy to help.

Let’s meet!