Transfer pricing methods

You have transactions with group companies or you are about to have transactions with group companies. You know that you need to determine a price for the transaction that is comparable to the price that third parties would have determined. Do you also know that there are certain methods to determine this arm’s length price? For each transaction you want to price, you need to choose a method. In doing so, you should choose the most appropriate method for your particular transaction.

What are the transfer pricing methods

Transfer pricing methods are different ways of arriving at an arm’s length price. The OECD defines five methods in its transfer pricing guidelines:

- The ‘comparable uncontrolled price method’ (CUP);

- The ‘cost plus method’ (CPLM);

- The ‘resale price method’ (RPM);

- The ‘transactional net margin method’ (TNMM); en,

- The ‘profit split method’ (PSM).

The specialists at Crowe Peak have extensive experience with the various transfer pricing methods and will be happy to help you select the most appropriate method in your particular case. The explanations on this page are informative and do not serve as advice. We strongly discourage you from selecting a suitable transfer pricing method (yourself) solely on the basis of this article.

We explain each of these methods in outline below. You may find this explanation more complicated than you are used to from us. We have done our best to explain the five transfer pricing methods conceptually in an understandable way, but nevertheless, the transfer pricing methods remain rather technical in nature.

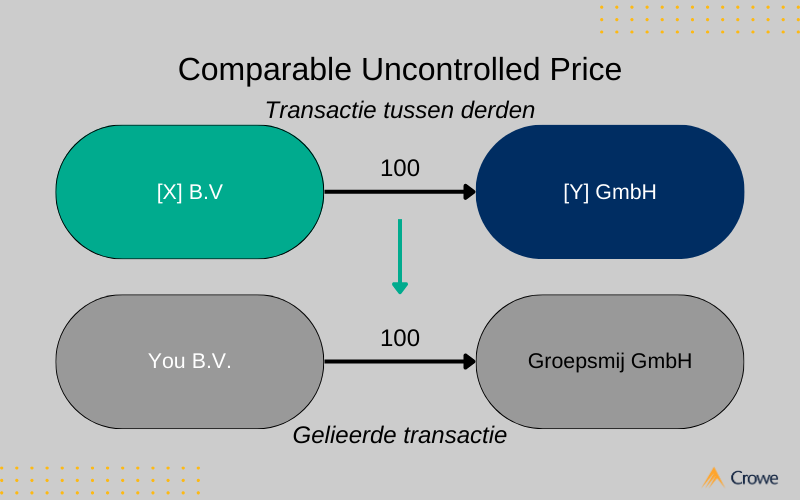

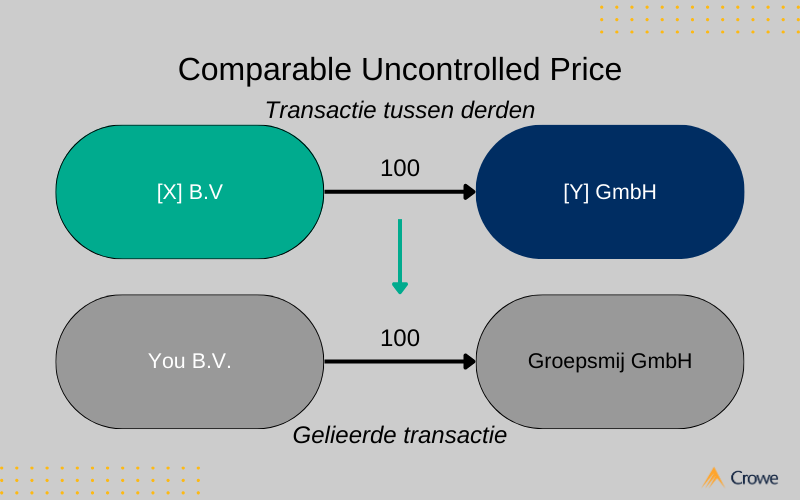

1. Comparable Uncontrolled Price Method

The CUP compares the price charged in the linked transaction with the price charged in a comparable transaction between:

- two independent parties, or;

- one of the parties involved in the linked transaction and a third party.

In practice, the CUP is usually applied to bulk commodities for which the market price is known or to loans.

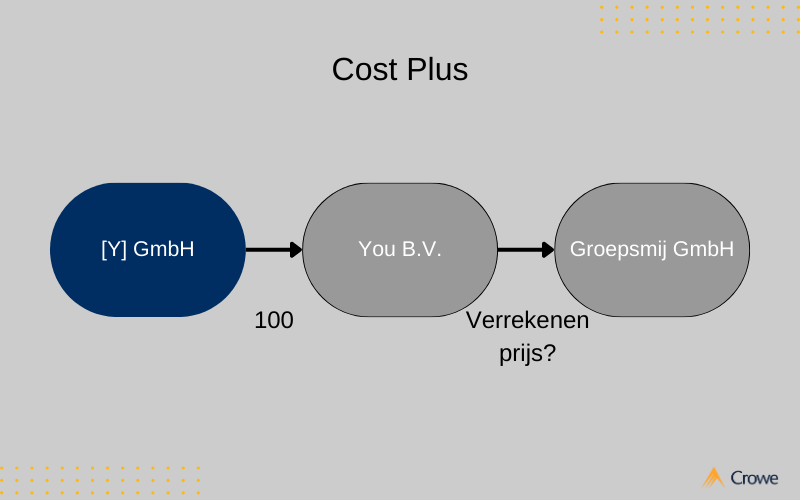

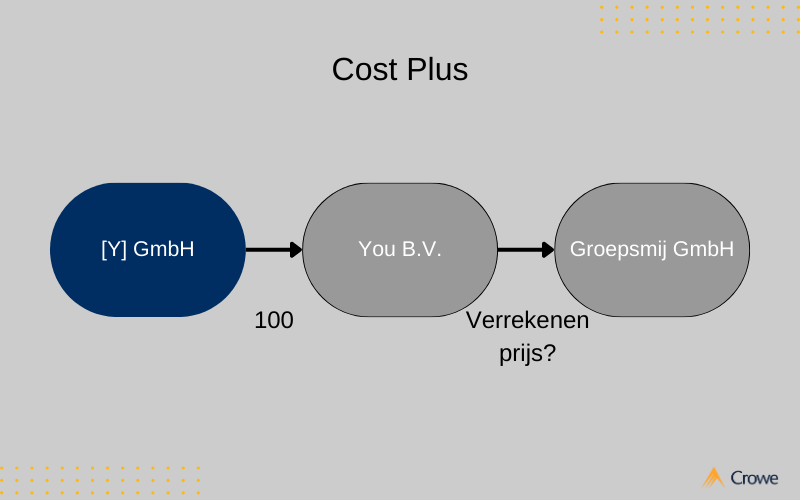

2. Cost plus method

The CPLM is applied in transactions between a supplier and a group company.

When the CPLM is applied, the total cost of producing the good is increased by a cost mark-up. The cost of production and the cost mark-up constitute the resale price to the group company. The cost mark-up is determined by analysing the cost mark-up applied in comparable third-party transactions.

To illustrate: You B.V. manufactures machine parts. You B.V. buys the raw materials for 100 from Y GmbH, a third party. You B.V.’s direct and indirect production costs are 50. Research by the transfer pricing consultants has shown that independent third parties apply a cost mark-up of 30%. Thus, the transfer price to Group Y GmbH is 195 (i.e. production costs (100 + 50) + 30% = 195).

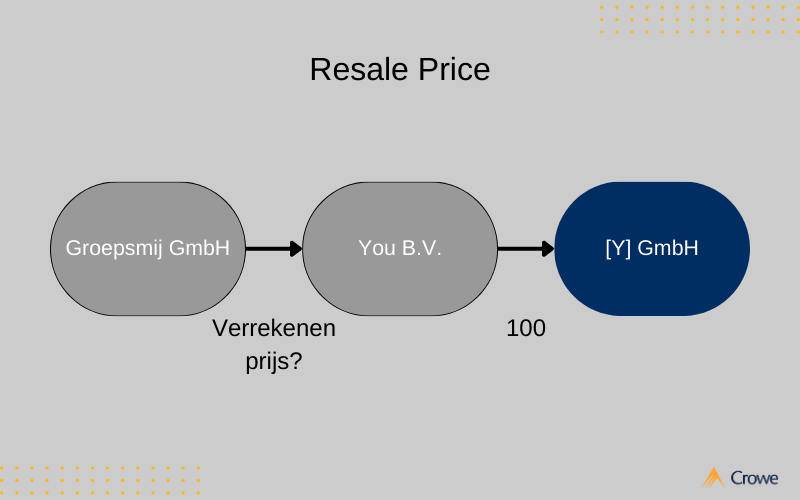

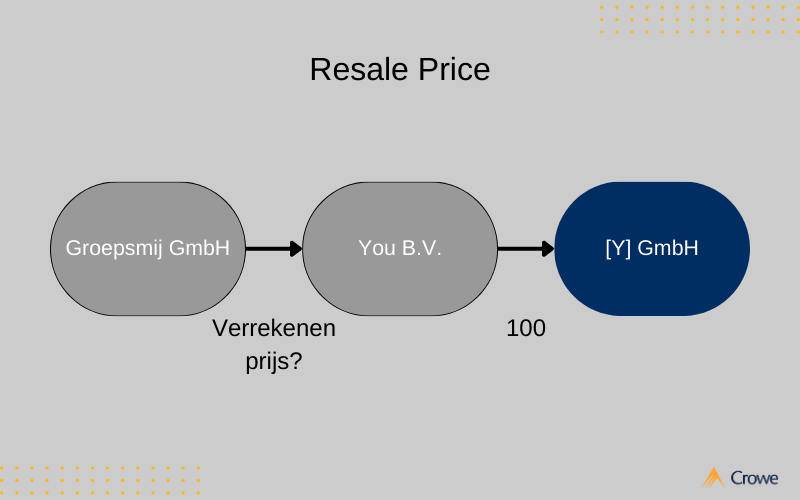

3. Resale Price Method

The RPM is applied in cases where a product is bought from a group company and resold to a third party. The transfer price, which is the price the reseller has to pay on an arm’s length basis for the product, is determined by reducing the sales price to the third party by an arm’s length gross margin. The arm’s length gross margin is determined using the gross margins achieved on transactions between third parties.

To illustrate: You B.V. sells machine parts made by Groepsmij GmbH for 100 to Y GmbH, a third party. You B.V. has to declare an arm’s length profit. Research by transfer pricing advisers has shown that independent third parties achieve a gross margin of 25% when selling similar machine parts. An arm’s length transfer price between Groepsmij GmbH and You B.V. is therefore 75. (25% of 100 = 25; 100 – 25 = 75).

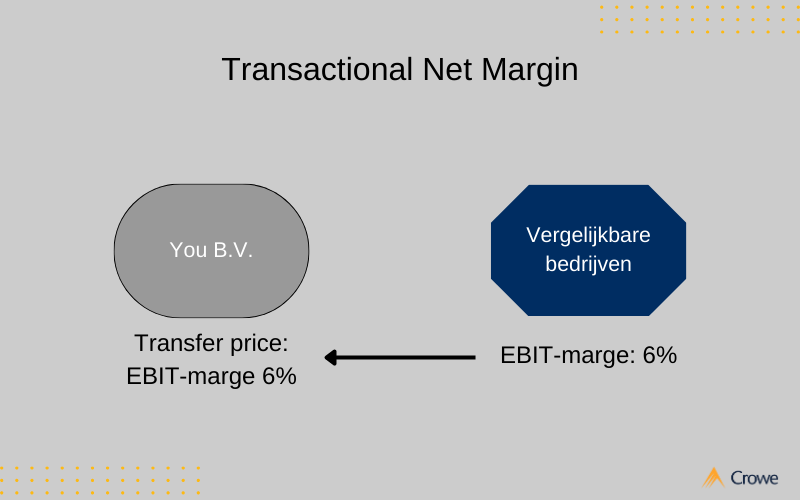

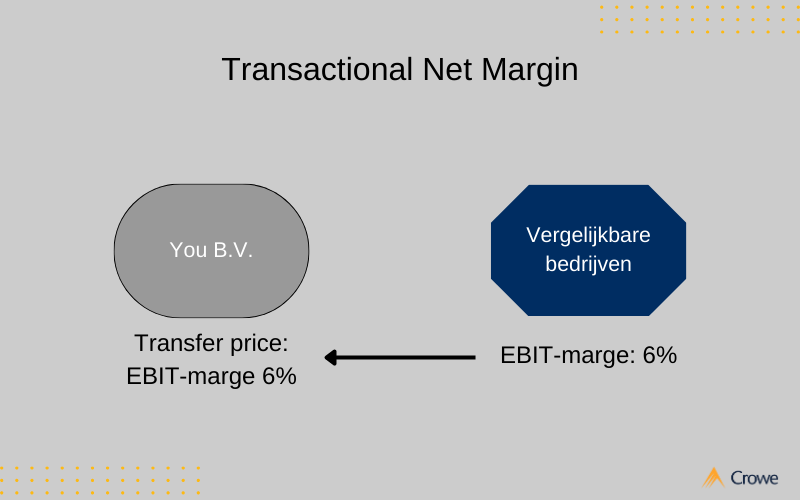

4. Transactional net margin method

The TNMM compares the operating profit margin (i.e. EBIT margin) achieved on the transaction with the group company with the operating profits achieved by independent companies in similar transactions/activities.

To calculate a margin, you need to be able to plot operating profit against something. When using the TNMM, there are many balance sheet and financial statement items against which to measure operating profit. Usually, operating profit is set against sales or total costs. As with selecting the most appropriate transfer pricing method, when selecting the balance sheet or financial statement item(s) against which operating profit is measured, you need to choose the most appropriate items for the specific situation. Crowe Peak’s specialists can advise you on this.

To illustrate: Groepsmij GmbH sells machine parts to its Dutch group company You B.V. You B.V. sells these products to independent third parties on the Dutch market. You B.V.’s advisers have determined that the TNMM is the most appropriate transfer pricing method to determine an operating profit for You B.V.. The operating profit should be set against revenue. The transfer pricing advisers have determined that independent third parties achieve an operating profit equal to 6% of turnover. If You B.V. has €1 million turnover, then an arm’s length operating profit for You B.V. will be €60,000 (i.e. 6% of €1 million).

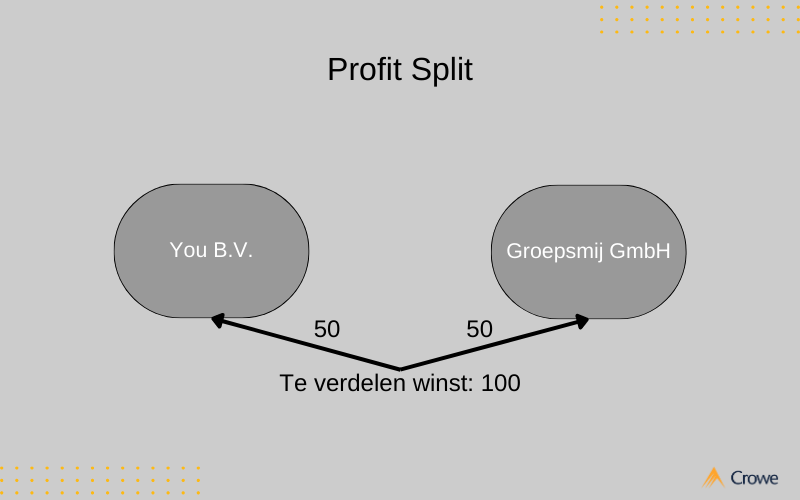

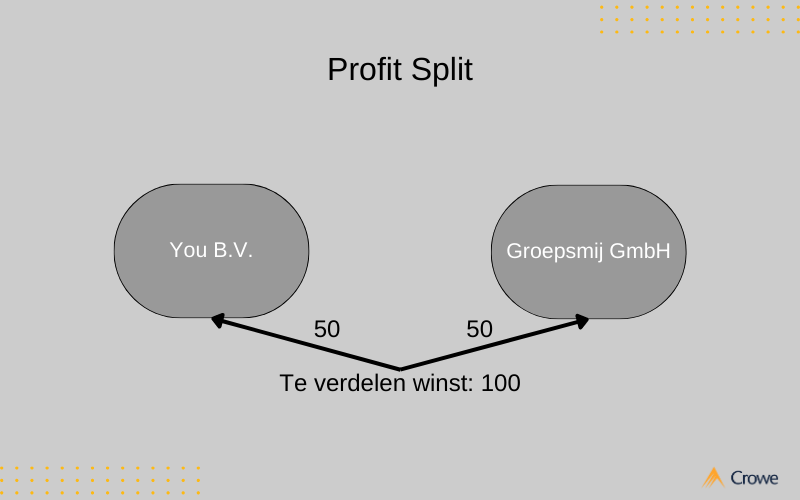

5. Profit split method

When group companies apply the PSM, the (operational) profit gained from the transaction is shared between the group companies involved. For a correct application of the PSM, the (operational) profit will have to be divided in a way that third parties would also have agreed in a similar situation.

We sometimes see clients actually applying this method. While it may feel fair to share risks and therefore profits and losses with each other, from a transfer pricing perspective this is often not correct. The PSM is only the most appropriate method in a limited number of cases. In addition, using the PSM is often not desirable either. While the method appears to be operationally simple to apply. In contrast, substantiating the arm’s length nature of the allocation key used is very difficult, as it can only be objectified and can never be determined objectively. As a result, the allocation key used will almost always lead to discussions with tax authorities. It is therefore always important in these -and other- cases to have an advisor look at the chosen transfer pricing method.

What if I don’t choose the most appropriate transfer pricing method?

What can happen if you do not choose the most appropriate transfer pricing method? You must substantiate in your transfer pricing documentation why you think the transfer pricing method you have chosen is the most appropriate one. When conducting an investigation, the tax authorities will always start from the transfer pricing method chosen by the taxpayer.

You are free to choose your own transfer pricing method, provided it leads to an arm’s length outcome for the specific transaction. If the Inland Revenue finds that the chosen transfer pricing method does not lead to an arm’s length outcome, the Inland Revenue will impose a transfer pricing correction.

A transfer pricing adjustment does not only affect your taxable profit. By taking into account a (fictitious) transaction, it must also show how the profit correction has been processed in the accounts. This could be, for example, through a current account position or the distribution of a (disguised) dividend. These (notional) transactions can then again affect your profit or taxation. For example, a current account position through the inclusion of an arm’s length interest rate may affect your profit and a (disguised) dividend may result in having to pay dividend tax.

Looking for more?

Do you need help choosing the most appropriate transfer pricing method for your situation? Please feel free to contact our transfer pricing specialists.

Nieuws & actualiteiten

Curious to see what we can do for your organization?

Let’s meet!